Investing in your clinic is the greatest return on investment (ROI)

Are rising inflation rates preventing you from investing in your practice? Fight inflation by taking advantage of IRS Section 179! Finance or purchase a Xoran 3D CT device and deduct the full purchase price from your gross income for 2022.

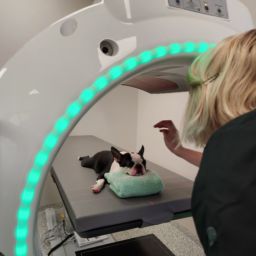

Now is the perfect opportunity to invest in your clinic. With the addition of a VetCAT or vTRON you can:

- Diagnose and treat same-day.

- Handle more complex pathology.

- Expand your treatment capabilities.

Contact us to place your VetCAT or vTRON order today!

According to IRS Tax Section 179, businesses can deduct up to $1.08M of qualifying equipment including, but not limited to, CT devices like Xoran’s VetCAT and vTRON. In order to qualify for the current tax year, finance or purchase equipment and put it into service by December 31, 2022. Consult with your independent CPA for further details on how this incentive applies to your practice. Learn more about how Section 179 deductions apply to your clinic at xorantech.com/section-179v/.